Introduction

Age verification when selling age-restricted products has long been a labor-intensive and error-prone process – both in physical stores and online. At the same time, biometric payment systems are rapidly evolving and changing the way transactions are authorized worldwide.

In markets like China or United Arab Emirates, payments via facial recognition have long been commonplace. Acceptance of such technologies is also increasing significantly in Europe. This becomes particularly relevant in industries where legal age restrictions, high customer expectations for convenience and efficiency, and stringent regulatory requirements converge.

1. Relevance and Drivers of Technology Development

Three key factors play a crucial role in why both automated age verification and biometric payment are currently of strategic importance for retail companies:

-

Efficiency: Age checks at traditional POS registers or self-checkout terminals cause waiting times and often lead to process disruptions.

-

Customer Expectation: Consumers are increasingly demanding fast, secure, and password-free payment solutions.

-

Regulatory Pressure: With the growing online availability of age-restricted products (e.g., wine, vapes, or cannabis), the requirements for legally compliant verification procedures are increasing.

Technology providers like Voltox address these requirements with modular AI solutions that integrate age verification and payment processes into a single system.

2. Age Verification in Physical Retail

In unmanned sales environments, including 24/7 shops that are accessible around the clock, as well as gas stations where customers can shop any time without staff, and self-checkout areas in supermarkets allowing scanning and paying for goods without direct assistance from a cashier, traditional age checks as conducted by sales staff still represent a pivotal bottleneck. This check is crucial to ensure that the sale of age-restricted products, such as alcohol and tobacco, is legally compliant and does not violate youth protection laws.

2.1 Initial Situation

Particularly in unmanned sales environments – such as 24/7 shops, gas stations, or self-checkout areas – traditional age checks are often a bottleneck. When an alcoholic product is scanned, staff must intervene, interrupting the checkout process and reducing throughput.

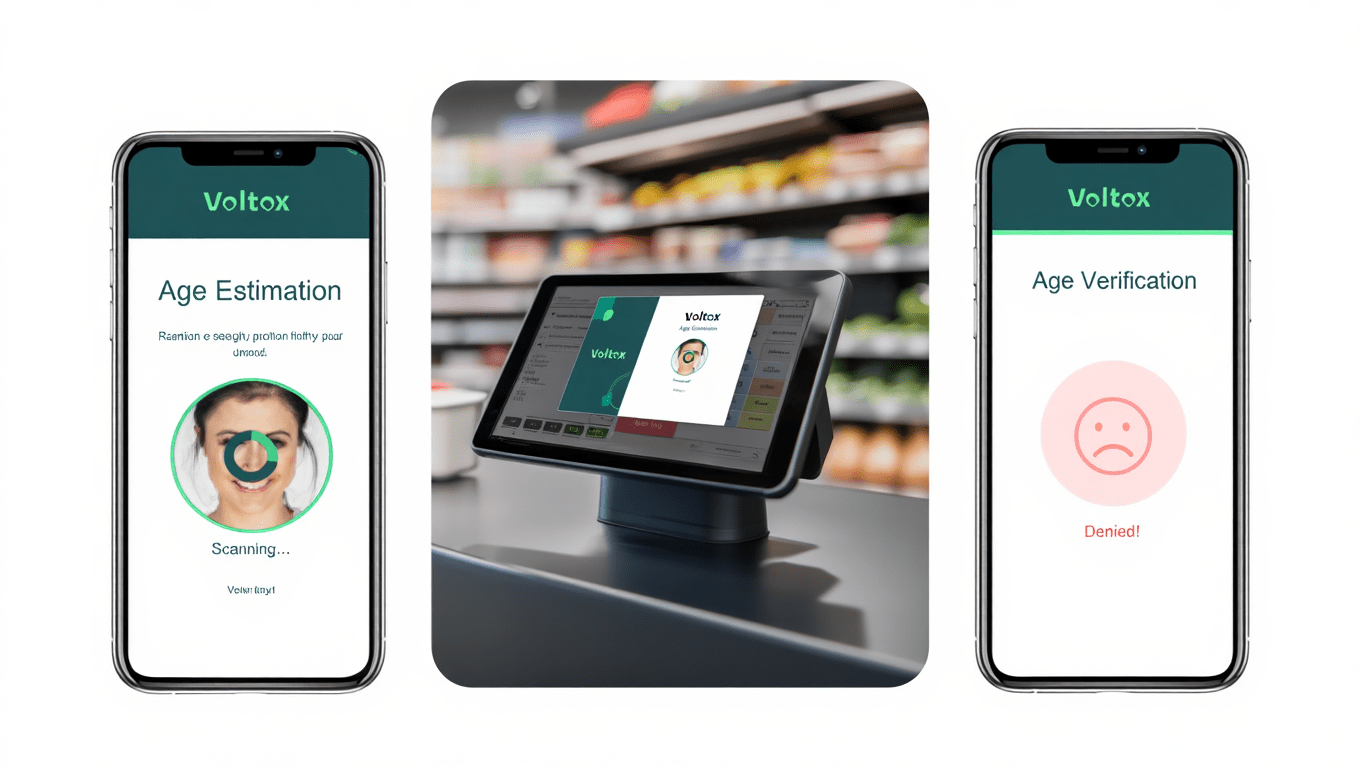

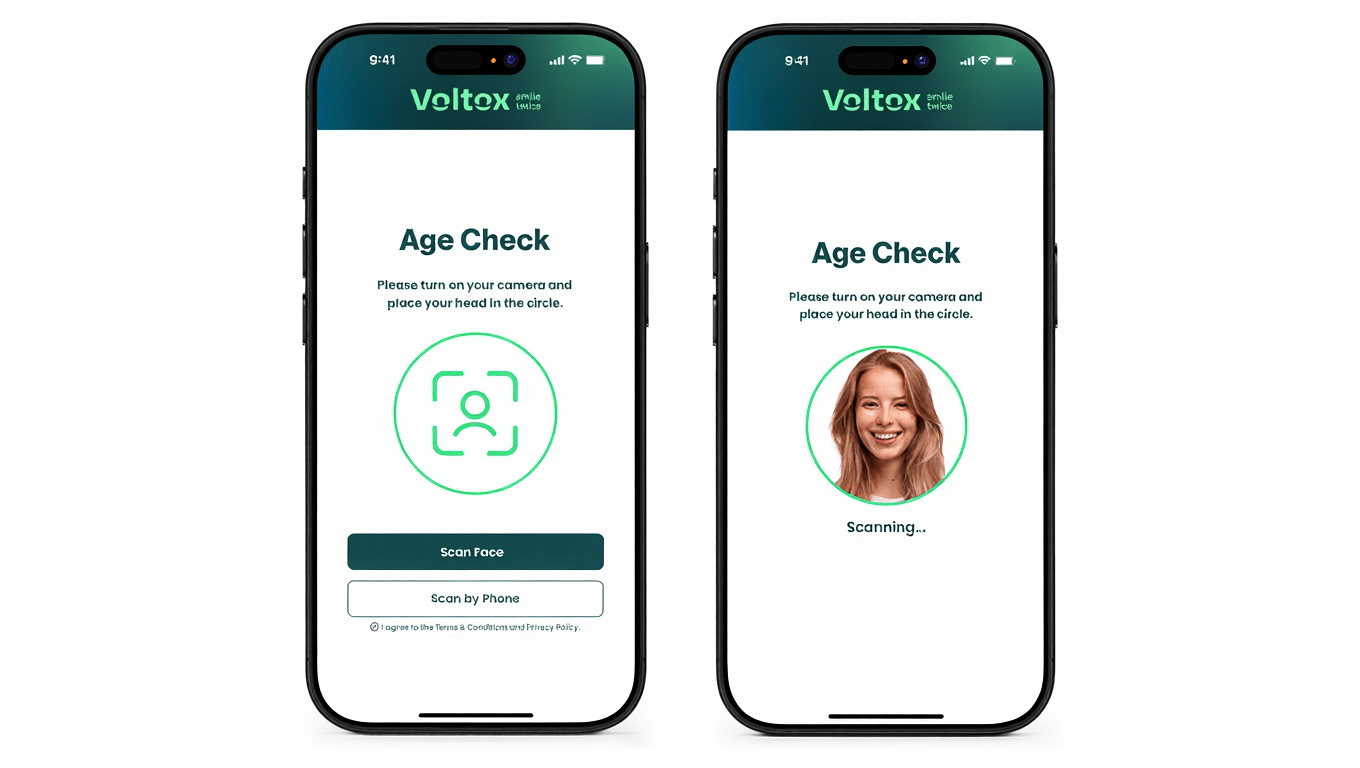

2.2 Technological Implementation

AI-based systems like Voltox Age Verification combine cameras, sensors, and algorithms for real-time age estimation. Biometric data is only processed temporarily and not stored – a key aspect regarding data protection and GDPR compliance.

2.3 Application Example

In a 24/7 shop, scanning an alcoholic product automatically triggers an age verification.

-

The verification takes place in under three seconds.

-

Customers can choose between facial recognition at the terminal or QR code verification via smartphone.

-

The payment process continues automatically after successful verification.

Result: No waiting times, lower staffing costs, and a more efficient checkout process.

3. Functionality of Age Verification

The systems use AI-based facial analysis with an accuracy of over 98%. If the estimate is close to a legal age limit, a fallback process (e.g., ID scan) is triggered. This prevents minors from accessing age-restricted products while allowing legitimate customers to complete the process with minimal interruption.

4. E-commerce and BNPL: Legal Necessity of Age Verification

In online retail, a click on "I am over 18" is no longer sufficient to ensure a buyer is old enough. Laws require retailers to use reliable methods for age verification, especially for products like alcohol and tobacco. This is also important for "buy now, pay later" offers, which can pose a risk for young buyers. Retailers must ensure their age checks are both effective and legally compliant to avoid legal issues and ensure the protection of minors.

4.1 Regulatory Framework

In e-commerce, checkbox solutions ("I am over 18") are not legally permissible. Both national regulatory authorities and European guidelines require robust age determination procedures. This concerns not only traditional age-related goods but increasingly also financial services such as "Buy Now, Pay Later" (BNPL).

An example: The Autoriteit Financiële Markten found in 2023 that around 600,000 BNPL transactions were made by minors – and called for mandatory age and identity checks.

4.2 Implementation in E-commerce

-

The system automatically recognizes products with age restrictions.

-

Verification is performed through ID scanning and selfie matching.

-

After successful verification, the purchase process is released.

Effect: Legal certainty, fewer purchase cancellations, and improved customer experience.

4.3 Age Verification for BNPL Payments

For BNPL payments, Voltox verifies age before releasing the installment payment. This fulfills regulatory requirements, legally secures merchants, and protects minors from over-indebtedness. The solution complies with GDPR, ISO 27001, and KJM guidelines.

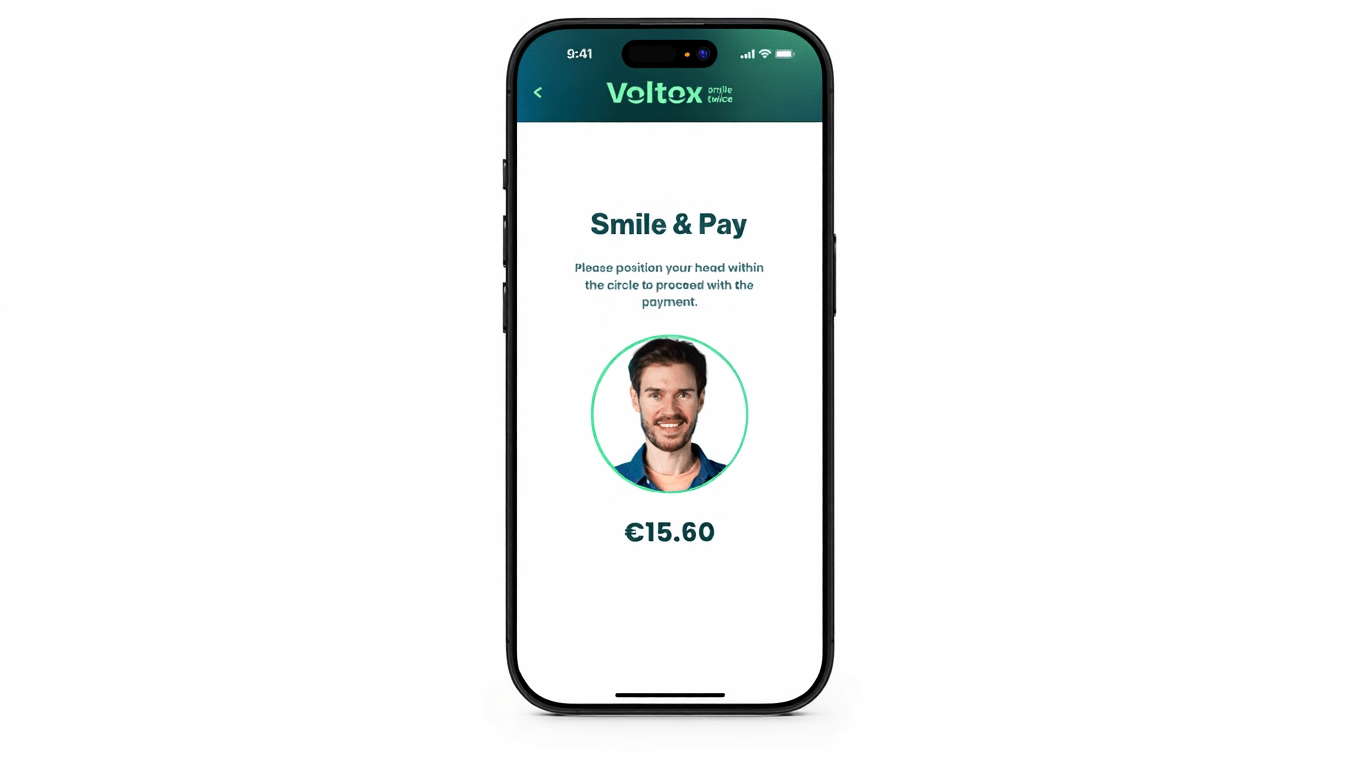

5. Biometric Payment Systems as a Logical Extension

With Smile Pay, Voltox offers an innovative and secure facial recognition solution for payment authorization. This technology allows customers to make their purchases simply and easily by just looking into the camera. This process eliminates the need for traditional use of bank cards, PIN numbers, or smartphones. By using advanced algorithms, the user's identity is verified quickly and securely, increasing both convenience and security in the payment process. Smile Pay not only ensures a seamless transaction but also helps to minimize fraud risks since biometric recognition is much harder to circumvent than traditional methods.

5.1 Physical Retail

-

Scanning of goods

-

Facial recognition as an authentication and payment step

-

Completion of the transaction in seconds

Benefits: Faster transactions, higher conversion rates, reduced hardware dependency, and reduced process complexity.

5.2 Online Retail and Mobile Applications

Biometric payment can also be implemented online. After completing the shopping cart, payment approval is done via face scan – authentication and payment are merged into a single step.

6. Integration of Age Verification and Biometric Payment

The combination of both technologies creates a seamless and scalable customer journey, enabling companies to offer seamless and personalized customer experiences across various touchpoints. This leads to better customer retention, increased trust, and ultimately increased customer satisfaction, as solutions can be tailored to meet individual customer needs and preferences.

-

One-time age verification through ID scan and selfie.

-

Storage of the biometric profile for future transactions.

-

Use of biometric identity for payment authorization and risk assessment.

Benefits:

-

Consistent process across POS and online channels

-

Lower friction in checkout

-

Strengthening security and compliance

-

Potential for automated credit checks in the BNPL area

7. Economic and Operational Benefits

Automated age verification and biometric payment systems are not only technologically innovative but also create measurable economic benefits. Companies benefit from more efficient processes, lower staffing costs, higher legal certainty, and an improved customer experience.

| Benefit Area | Description |

|---|---|

| Process Optimization | Elimination of manual checks, faster checkout |

| Reduction in Staffing Costs | Relief for employees in personnel bottleneck situations |

| Legal Certainty & Compliance | Fulfillment of legal requirements |

| Objectivity & Transparency | AI-based decisions instead of subjective assessments |

| Improved User Experience | Lower dropout rates, higher comfort |

| Abuse Prevention | Protection against unauthorized access and over-indebtedness of minors |

| Future-Proof Payment Infrastructure | Independence from card and password systems |

8. Recommendations for Retailers

Clear strategies and structured implementation steps are required for the introduction of automated age verification and biometric payment systems. In this session, we show retailers how to efficiently set up pilot projects, measure key figures specifically, and integrate solutions scalable into existing systems.

- Initiate pilot projects: e.g., in stores with alcoholic products or BNPL payment paths.

- Define key figures: including verification time, dropout rate, customer satisfaction, personnel deployment.

- Develop a scaling strategy: Integration into POS and online channels after successful piloting.

- Regular evaluation: Review of AI models, data protection, and compliance standards.

- Ensure modularity: Design systems in such a way that future regulatory requirements can be mapped.

Conclusion

Automated age verification and biometric payment systems mark a paradigm shift in retail. They increase efficiency, strengthen legal certainty, and significantly enhance the customer experience.

Solutions like Voltox Age Verification and Smile Pay demonstrate how identification, verification, and payment can

merge into a unified, seamless process.

Thus, retail companies not only technologically future-proof themselves but also meet the increasing regulatory requirements in an

increasingly digitized market.

If you have further questions about VOLTOX and the integration into Smartstore or would like to arrange a live demo, we are at your disposal. You can reach us via the contact form, by email at info@smartstore.com or by phone from Monday to Friday between 10 a.m. and 4 p.m. at +4923153350.

VOLTOX GmbH

An der Hessenhalle 1-3

DE-35398 Gießen

Phone: +496415592740

Email: sales@voltox.ch

https://www.voltox.ai/